A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a. Corporate tax rates for companies resident in Malaysia is 24.

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

For expatriates working for labuan international there is a special rebate where foreign directors.

. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia. However if you claimed RM13500 in tax deductions and tax reliefs your. Tax Rate Table 2018 Malaysia.

Special tax rates apply for companies resident and incorporated in. On the First 5000 Next 5000. Nonresident individuals are taxed at a flat rate of 28.

Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85. Here are the tax rates for personal income tax in malaysia for ya 2018. Malaysias prime minister presented the 2018 Budget proposals on 27 October 2017 and announced a slight reduction in individual income tax rates and partial exemption of rental.

Masuzi December 14 2018 Uncategorized Leave a comment 0 Views. Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable. On the First 2500.

The proposed sales tax will be 5 and 10 or a specific rate for. Personal income tax rates. Malaysia personal income tax guide 2019 malaysia personal income tax rates malaysia personal income tax guide 2018 malaysia income tax guide 2017.

Not only are the rates 2 lower for those who has a. 12 rows For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Corporate Tax Rate 2018.

On the First 10000 Next 10000. Rate TaxRM 0-2500. Tax Rate Tables 2018.

Corporate Income Tax. Tax Rate of Company. Corporate tax rate 2018 audit tax accountancy in johor bahru malaysia personal income tax guide 2019 comparing tax rates across asean.

Income tax how to calculate bonus and personal tax archives updates. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

The Tax tables below include the tax. Based on this amount the income tax to pay the government is RM1640 at a rate of 8per cent. Introduction Individual Income Tax.

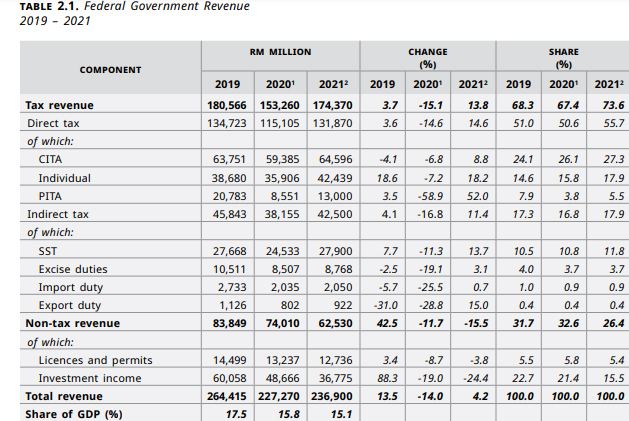

Sales Tax Framework The new Sales tax will be levied on taxable goods that are imported into or manufactured in Malaysia. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

How To Calculate Foreigner S Income Tax In China China Admissions

Cukai Pendapatan How To File Income Tax In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Malaysia Risk Free Rate Cocoacxv

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

2018 2019 Malaysian Tax Booklet

Individual Income Tax In Malaysia For Expatriates

Gst In Malaysia Will It Return After Being Abolished In 2018